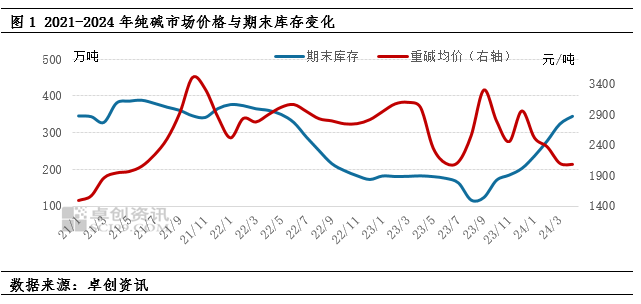

[Introduction] The fluctuation of soda ash spot market price is obviously driven by supply and demand. Inventory can reflect the results of the supply and demand game to a certain extent. Therefore, inventory has a certain impact on the soda ash market price, and the trends of the two generally show a negative correlation.

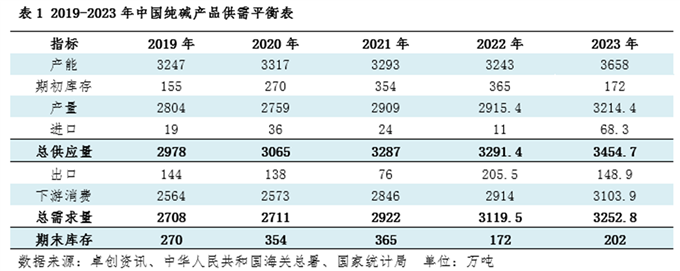

Ending inventory = total supply - total demand, which reflects the results of changes in supply and demand. Soda ash production capacity, output, and consumption will all show growth from 2019 to 2023, and the overall demand growth rate is higher than the supply growth rate. The supply and demand of the soda ash industry has changed from loose to tight and then to loose again, with industry inventories first falling and then increasing. The industry maintains a high level of prosperity, with prices and profits remaining at high levels. In 2024, soda ash production capacity will be further expanded, supply will become looser, ending inventory will show an increasing trend, and both price focus and profit margin will decline year-on-year.

The compound growth rate of China's soda ash production capacity from 2019 to 2023 is 3.4%. The output first decreased and then increased, mainly affected by factors such as supply and demand, environmental protection, and safety. Float glass market demand will improve in 2020, and production capacity will expand significantly in the second half of the year. Coupled with the continuous development of the new energy industry, the demand for soda ash from photovoltaic glass and lithium carbonate continues to increase. The growth rate of soda ash demand will accelerate from 2021 to 2022, and the ending inventory will decrease significantly, the market price center of gravity moved steadily upward. As the prosperity of the industry improves, market prices remain high, industry profitability is good, new devices are gradually put into production, and a total of 5.5 million tons of new production capacity will be added in the second half of 2023. Supply tends to be loose, ending stocks have rebounded, and prices have focused on Somewhat downward.

New production capacity will be gradually released in the early part of 2024, and new production capacity will continue to be put into production. In addition, the industry still maintains a certain profit margin, manufacturers maintain a high enthusiasm for starting operations, and the supply of soda ash continues to grow. Against the background of increased supply pressure for downstream float glass, the consumption of soda ash has weakened marginally. The main increase in demand for soda ash still relies on photovoltaic glass and lithium carbonate. The growth rate of demand is not as fast as the growth rate of supply. The ending inventory of the soda ash industry continues to increase, and the market price center of gravity has shifted downward.

The two more important inventory components in the ending inventory are the inventory level of upstream production companies and the inventory level of downstream raw materials. These two data affect the future pricing expectations of soda ash companies and the procurement progress of downstream users, thus having a certain impact on market prices.

Judging from the characteristics of soda ash enterprise inventory and market price fluctuations, there is a negative correlation between the two. The main factors affecting inventory changes are market supply and demand conditions and market expectations. Generally, when the market turns from rising to falling, market expectations change, traders and downstream users become more cautious and wait-and-see, and purchases generally slow down, resulting in increased shipping pressure on soda ash manufacturers. When inventories increase to a certain level, soda ash manufacturers take more A “price-for-volume” strategy, whereby prices fall. The price increase often starts from the high point of inventory. Only when the market has strong expectations of price increases and the enthusiasm of downstream users and traders to take goods improves will the inventory of soda ash manufacturers be transferred downward. The inventory changes of soda ash manufacturers from 2021 to 2022 are basically in line with the above rules. It is slightly different in 2023, and prices still fall when inventory is low. Mainly because new production capacity will be concentrated in the second half of 2023 and market expectations are pessimistic. In order to lock in orders when profits are higher, manufacturers took the initiative to sell from warehouses in the first half of the year and take orders at a discount.